Richard Guillot, CFP®

President/CEO

Richard (Ricky) Guillot has been active in the small business lending market for over 30 years. He began his career in commercial banking and served...

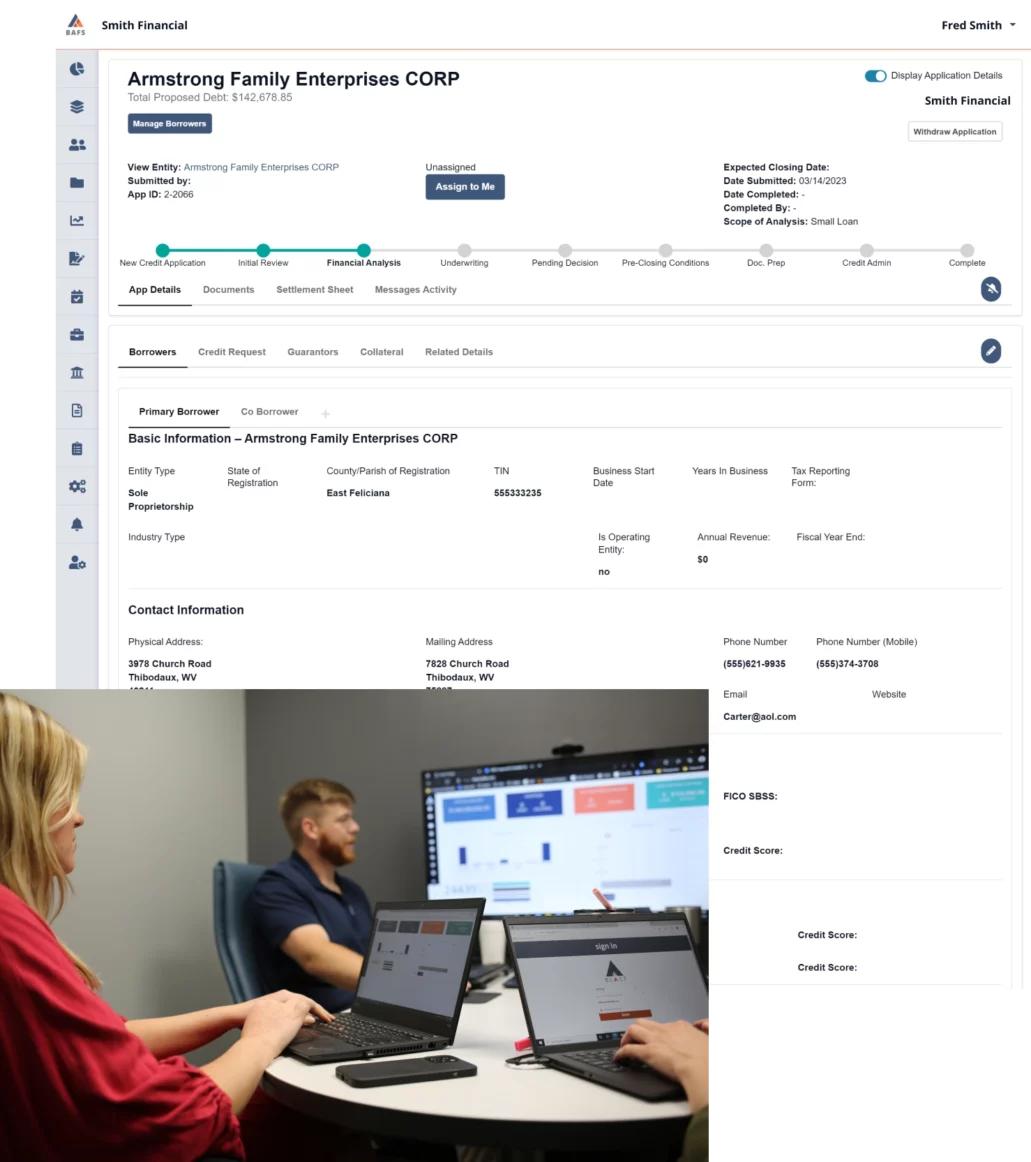

We developed the technology. We have the people.

Now you have the choice to use one, the other, or a combination of both for your commercial lending program.

Business Alliance Financial Services (BAFS) is a privately-owned financial services organization providing commercial loan processing, servicing, training, and consulting to financial institutions.

Founded in 2009, BAFS began with a mission and seven partner financial institutions. In 2010, BAFS expanded services to the state of Texas, added two additional Louisiana partners during 2011, and onboarded clients in Arkansas in 2012. We delivered our proprietary BLAST® commercial lending platform in 2014 and have been expanding it ever since. We now serve financial institutions all over the country, with partners in Pennsylvania, California, Nevada, Alaska, and Florida — and we’re still growing.

Supporting and enabling the growth of our clients’ businesses is our top priority. A partnership with the BAFS team enables stress-free access to new commercial lending business that will confidently grow your institution.

Our commitment to provide innovative solutions and services to our clients across the nation will never waiver. Acknowledgment as a national leader in business lending services with a reputation of being the best at what we do each day is our ultimate goal.

Growing and expanding the needs of our clients’ businesses is our top priority. The success of many financial institutions is reliant on a cost-effective, high-quality platform that offers exceptional performance and unrivaled support.

The BLAST® Cloud-Based Lender Operating System provides financial institutions with a daily, interactive, and cost-effective approach to establishing and maintaining a successful commercial loan program. We provide solutions to financial institutions that enable them to grow, thrive, and better serve their clients.

BAFS enables each client to offer business solutions to their current and prospective customers

and their communities in a way that further enhances client loyalty and market presence. We

provide solutions and services to businesses and a commitment to your firm’s success.

With decades of combined financial management and commercial lending experience, BAFS’ leadership team provides the skills, insights, and hands-on application expertise you need to manage and optimize your clients’ day-to-day operations and improve their loan management processes.

Richard (Ricky) Guillot has been active in the small business lending market for over 30 years. He began his career in commercial banking and served...

Shannon White started his financial career in 1991 and has worked for both community and regional banks. Most of his career has been spent in commercial lending...

During his 30 years in the banking and finance industry, Steve has acquired the unrivaled knowledge and experience needed to oversee BAFS’ Loan Audit & Review departments. In this capacity, he oversees...

Joining BAFS with nearly 25 years of progressive product management and marketing experience in technology and finance, Jeff is responsible for the company’s ...

Jason brings over 20 years of information technology industry experience and over 10 years of service in technology management roles within the Financial Services...

Kyle joined BAFS bringing over 20 years of client care management experience from an S&P 500 technology company, specializing in driving exceptional client...

Steve joined BAFS in May of 2019 and is responsible for the company’s financial planning, accounting, tax, payroll, and financial performance and repor...

BLAST® is being developed with support from Louisiana Economic Development’s Office of Entertainment Industry Development.

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!