BAFS Announces Market Expansion

Providing Financial Institutions With an Industry-First Combination of Commercial Lending Technology and Service

Whether you need our industry-leading, proprietary commercial lending software, our on-call commercial lending services and expertise, or something in between, BAFS will meet you where you are to grow your business.

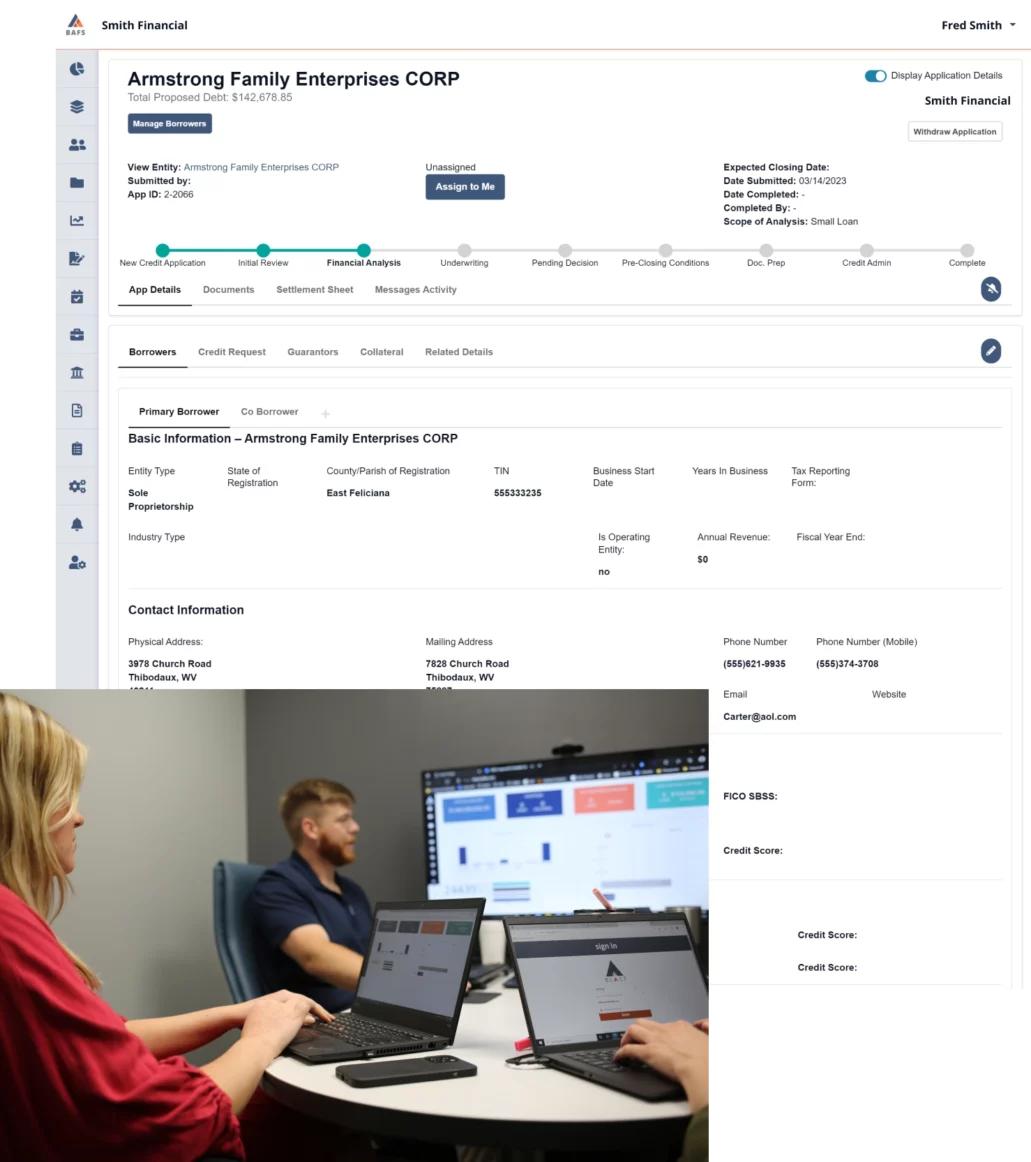

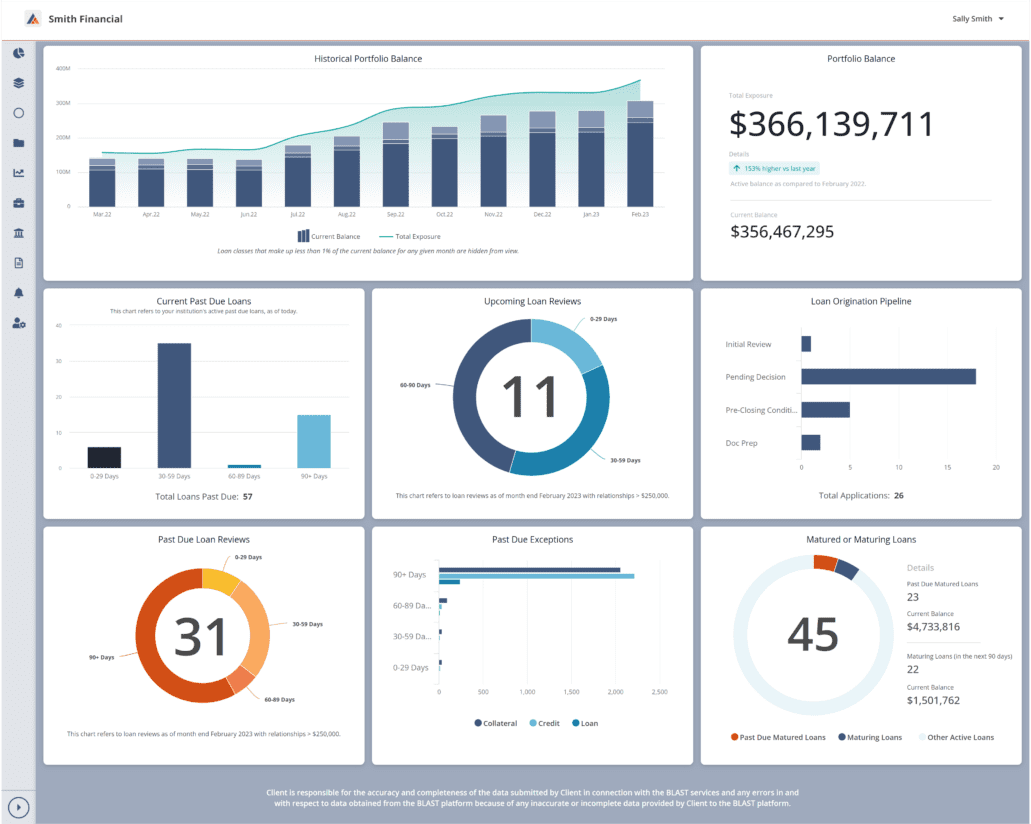

You’ve invested in your team. Our BLAST® software platform enables your team to efficiently execute and manage all aspects of commercial lending.

Let BAFS’ experienced team serve as your in-house commercial lending and credit administration department at a fraction of the cost.

BAFS’ multi-faceted approach to learning offers both software training and lender education using a range of methods including webinars, onsite training, remote learning, and self-directed video.

Whether you utilize your own in-house back office or take advantage of the BAFS full-service organization, BAFS’ Client Experience Team is available to solve problems and knock down barriers to your success.

BAFS (Business Alliance Financial Services) is a privately-owned company that provides financial institutions with the best of commercial lending software and services.

Founded in 2009, BAFS began with a mission and seven institutions. We began delivering our proprietary BLAST® platform in 2014 and now service financial institutions all over the country with clients in Pennsylvania, California, Nevada, Alaska, Florida, and growing.

Providing our clients with exceptional commercial lending software and services is at the core of everything we do.

See what our team of experts are doing to help our partners succeed, both today and in the future

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!